In just a few hours, $APE is set to release a large number of tokens into the market. The total value of these tokens is a whopping $196.5 million, or 40 million APE tokens set to be unlocked, 4% of total supply or 11% of Circulating Supply.

To understand the distribution of these tokens, we can look at the initial allocation. The ecosystem fund received the largest portion at 62%, followed by YUGA Labs and charity at 16%, launch contributors at 14%, and BAYC founders at 8%. It's worth noting that only 37% of these tokens are currently available on the market.

Previously, there was a smaller token unlock in September of 2022, with 25 million APE tokens released to launch contributors 1, who played a critical role in bringing APE to life. Until now, only the initial airdrop, treasury (DAO), and C1 had token unlocks.

Now, we are on the brink of the biggest token unlock since the launch of APE. On March 17, a whopping 40 million APE tokens (US$196 million) will be unlocked. This accounts for 4.06% of the total supply or 11% of the circulating supply.

The market's response to this large influx of tokens is yet to be seen, but it's certainly an exciting time for APE investors and traders. It will be interesting to see how the market reacts and how the token unlocks impact the broader crypto landscape. ( I will not add things that you already know, Token Distributions/allocations etc.)

Upcoming Unlocks Distribution:

When it comes to the upcoming APE token unlocks, it's important to take a closer look at the distribution of those tokens to get a better understanding of what impact the release could have on the market. Here's a breakdown of how those tokens are set to be distributed:

Investor: 25.00 M APE (2.50% of Total Supply)

Charity: 277,000 APE (0.03% of Total Supply)

Dao Treasury: 7.34 M APE (0.73% of Total Supply)

Investor 2: 831,000 APE (0.08% of Total Supply)

BAYC Founders: 2.22 M APE (0.22% of Total Supply)

Yuga Labs: 4.16 M APE (0.42% of Total Supply)

Investor 3: 757,500 APE (0.08% of Total Supply)

It's worth noting that the largest portion of the upcoming token unlocks are set to go to contributors, accounting for 25 million APE tokens. Meanwhile, the charity and launch contributor allocations are relatively small by comparison. The distribution to DAO Treasury, BAYC Founders, and Yuga Labs are also noteworthy.

Supply Shocks:

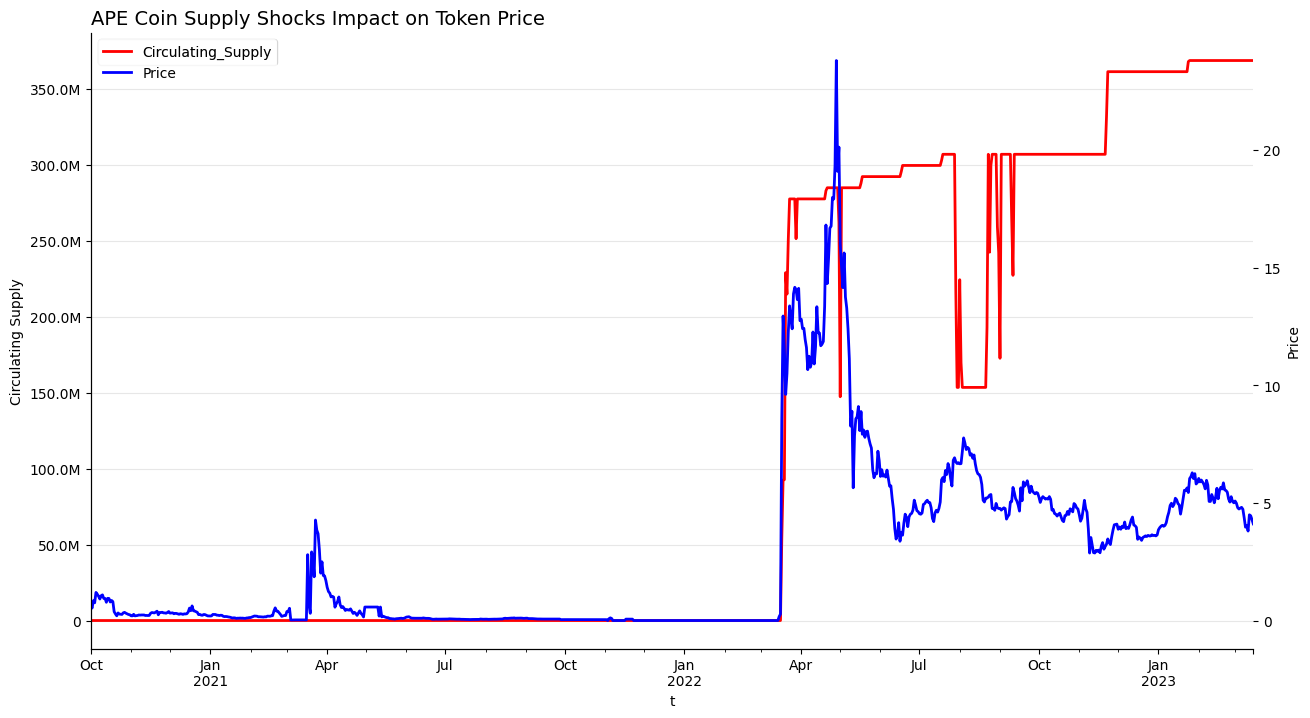

Supply shocks are a critical factor that can impact the price and overall sentiment. Looking at the historical data, we can see that $APE has experienced several supply shocks, and the market's response has been mixed.

Currently, only 37% of the total $APE supply is in circulation, as shown in Graph (1) below. The initial launch of $APE during the bull market in April 2021 involved the release of 27% of the total supply. This led to a 70% increase in the token's price range. However, as the end of the bull market approached, the token's price began to freefall, dropping from $25 to $7 in just a few weeks. It's worth noting that this decline was likely due to the release of 27% of the total supply during the token's initial launch, which had already caused a price pump and an eventual exit pump.

After the bear market began, $APE experienced smaller supply shocks. One notable example is the September 2022 unlock, which accounted for 8.77% of the total supply. Interestingly, the token's price began pumping before the unlocks and started to decline after the unlocks were released, with a price decline of 25% range.

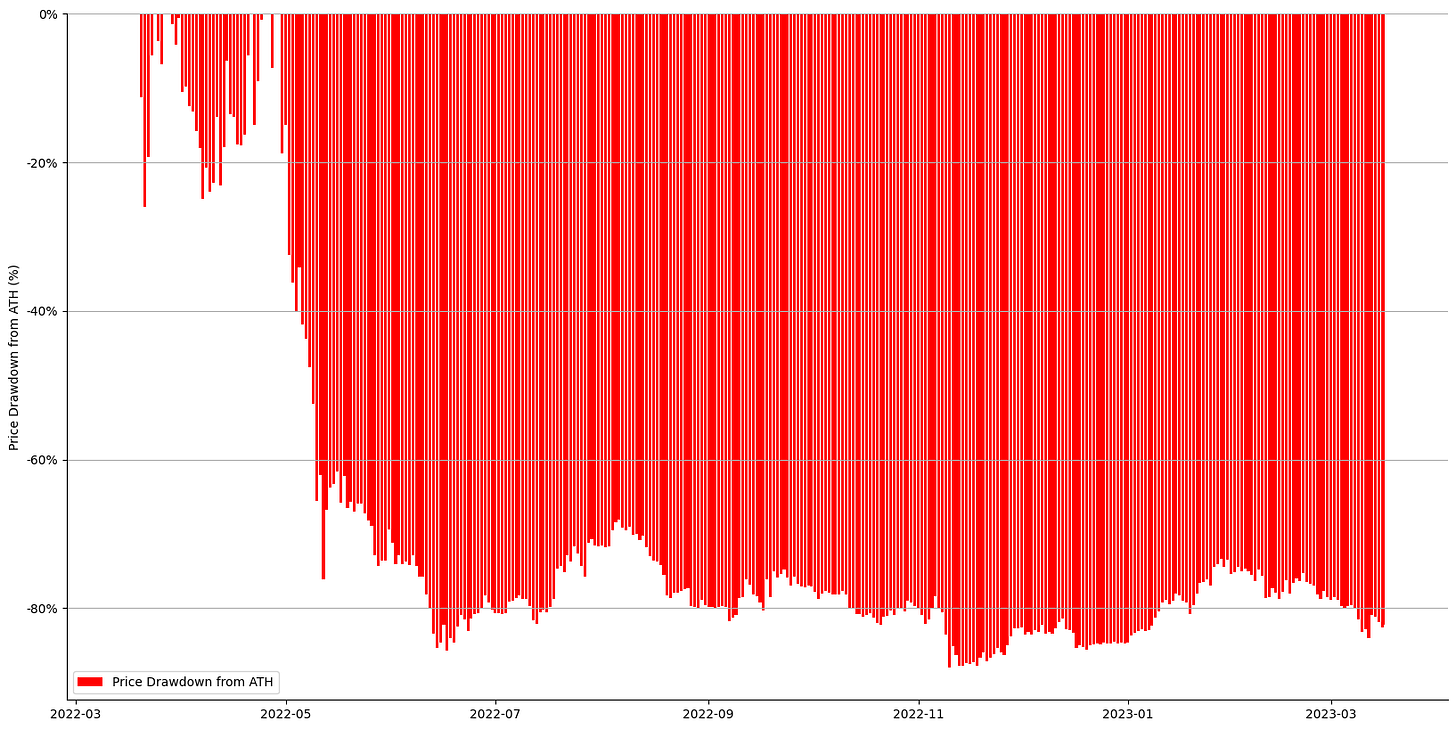

Note: The token $APE is down -88% since ATH, like other tokens.

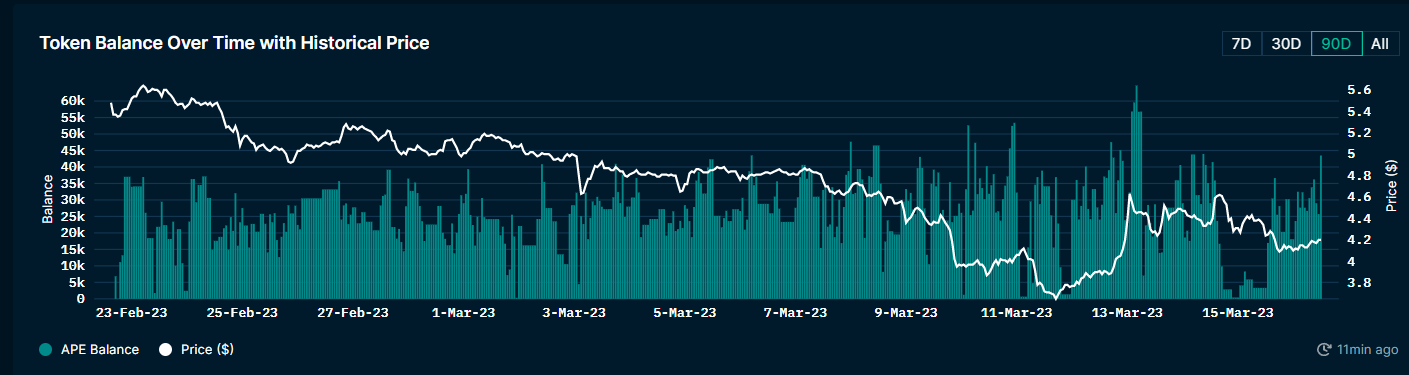

Now, $APE is set to experience its largest unlock yet, accounting for 4% of the total supply, or $169 million. It will be interesting to see how the market responds to this unlock, considering that the price has already experienced a pump from $3 to $6 earlier this year. would be Interesting to see how this unlock will affect the token's price and market sentiment going forward.

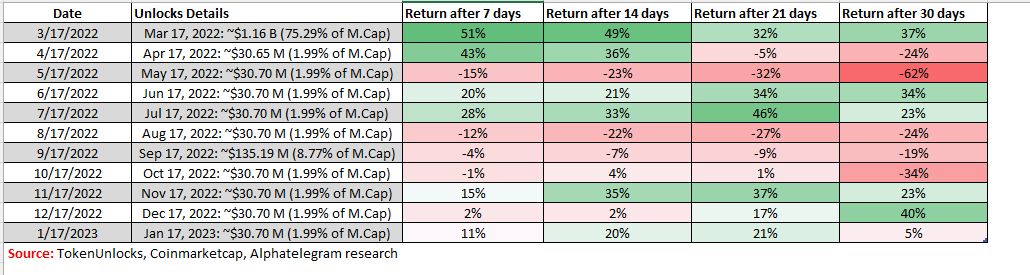

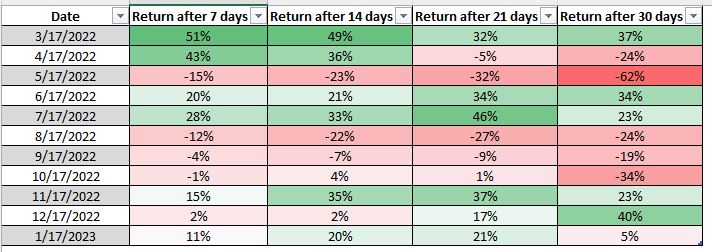

The historical price performance following token unlocks shows a mixed pattern. However, looking at the average returns since launch of tokens, the overall impact of unlocks seems to be positive, with the price moving up by an average of 10% in the 7 days after the unlocks were released. In the 14 days following the unlocks, the price typically stays within a range of 12% to 20%. Interestingly, when we look at the 30-day returns, the price tends to end up negative or zero, with most negative returns observed in this period. And bullish if market overall sentiment is positive | because in bear market bullish unlocks thesis won’t work much.

One possible explanation for this pattern is that retail investors tend to stay bearish before the unlocks, resulting in negative funding rates and heavy shorting positions. As a result, market players with access to liquidity pump up the price due to the availability of more liquidity, leading to heavy positioning. However, in the end, the unlocks bearish thesis seems to play out, and the price eventually starts to decline, leading to negative or zero returns in the 30 days following the unlocks.

Investors and traders should keep these dynamics in mind when assessing the potential impact of the upcoming $APE token unlocks on the market.

Current Holders:

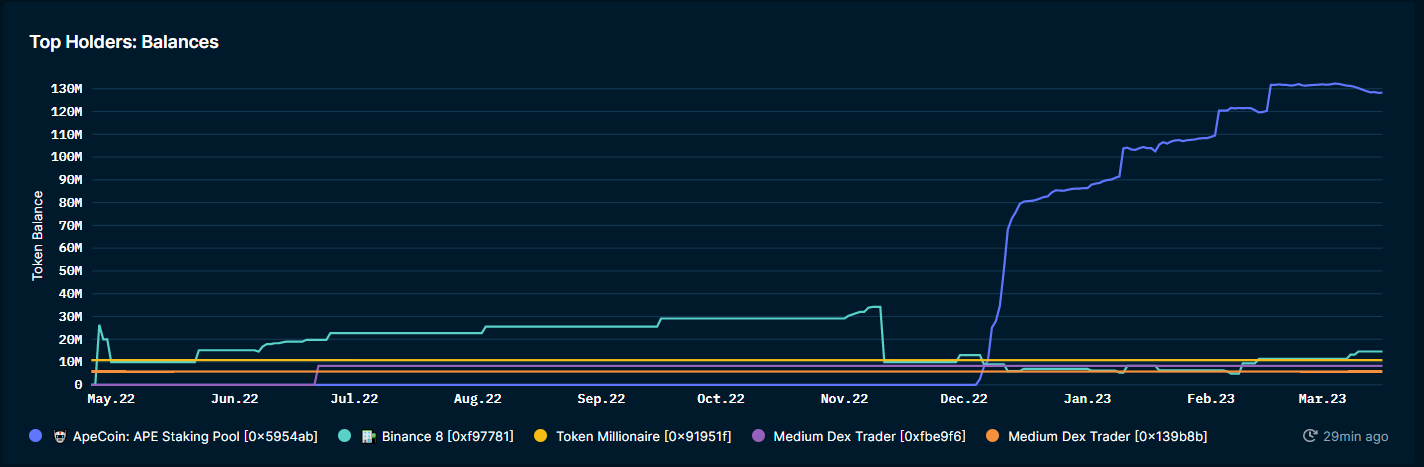

Examining the current distribution of $APE, it's worth noting that a significant portion of the supply, around $128 million or 13%, is held in the APE staking pool. $APE started staking in December 2022, and 175 million $APE will be distributed over three years. Year 1 will see the most significant release, with 100 million $APE, and this number will scale lower each year. By the end of the three-year period, 17.5% of the total supply of $APE will be released through staking.

The $APE-only pool will continue at a 30% share of each year's distribution total. Additionally, the average floor prices of BAYC/MAYC/BAKC in the last quarter of each year will determine the share for the next year. This strategy is in place to accommodate for price fluctuations over time.

Regarding the holdings of exchanges and investors, 1.46% of the supply is held by Binance, while approximately 3% of the supply is held by three different wallets, likely held by traders and investors who have been holding for an extended period. While it’s different talk that how this scheme will end up in lower token prices and rewards as well at the end but It will be interesting to see how the staking program evolves and what impact it will have on the token's price and market sentiment in the long term.

Smart Money:

Looking at the smart money wallets, we can see that the balance of APE tokens has decreased significantly compared to May 2022. Currently, smart money wallets hold around $1.28 million worth of APE tokens, whereas in May 2022, the balance was around $12 million.

It's worth noting that the APEcoin staking program likely contributed to this decline in smart money balance. Traders and investors who held APE tokens in smart money wallets likely put their tokens into staking to earn rewards instead of trading them on the market.

Examining some of the top holders in smart money wallets, we can see that Wintermute holds around $100,000 worth of APE tokens, and they are actively trading the tokens. On the other hand, Matchibrother holds around $14,000 worth of APE tokens, and they are mostly staking them as they are primarily focused on NFTs. Additionally, Genesis Trading holds over $400,000 worth of APE tokens, but they haven't moved their tokens since March 2022.

Overall, the smart money wallets currently hold a relatively small amount of APE tokens, with limited activity observed in recent months. It remains to be seen whether this trend will continue or if we will see a shift in smart money wallets' balance in the future.

Wintermute: 0x280027dd00ee0050d3f9d168efd6b40090009246

Genesis trading: 0x0548f59fee79f8832c299e01dca5c76f034f558e

machibigbrother: 0x020ca66c30bec2c4fe3861a94e4db4a498a35872

Exchanges:

Looking at the exchanges holding APE tokens, it's worth noting that only around 3% or $33 million worth of APE tokens are currently on exchanges. Examining the activity on exchanges over the last 7 days, we can see that Kucoin, Binance, and Paribu exchanges saw deposits of above $200,000. Additionally, smaller exchanges saw deposits totaling approximately $1.3 million worth of APE tokens.

However, when we look at the withdrawals side, major outgoing withdrawals of around negative $10 million were observed from Coinbase. This raises the question of who the buyers are and what their intentions are

It's clear that the withdrawals are 9 times more significant than the deposits, suggesting that there may be significant market activity occurring behind the scenes. It remains to be seen who is betting on $APE and what their strategies may be.

Sum:

Examining the current market of $APE, we can see that the funding rates are currently negative, indicating bearish sentiment in the market. However, the token's price has been moving slightly positive, up 10% for the day at the time of writing.

Overall, understanding the historical dynamics of $APEcan provide valuable insights into the token's potential future performance. From examining the current distribution of tokens, supply shocks, staking program, smart money wallets, and exchange dynamics, we can get a clearer outlook on the token's future.

Fractals are the key to unlocking nature's secrets. They are the patterns that repeat, the recurring cycles that constantly remind us that history is repeating itself. - Tony Robbins

It remains to be seen how the upcoming token unlocks will impact the market and how traders and investors will position themselves in response. However, by digesting the historical dynamics of $APE, we can gain a better understanding of potential market movements and make informed decisions about investing in this token.

As with any investment, there are always risks involved, and investors should conduct their own research and make decisions based on their individual risk tolerance and investment goals (NFA). Good luck to all those interested in $APE and its future prospects.

Wallet worth Monitoring:

0xe3792a9c235d434b702023b33f03c48c41631090

0xcfa96b792777bf2a63058d99128fceadf341d918

0x5d550635f87e21337462b582dff589f552e609ae

Update: $APE traded for 2 dollars as of June 2023 | Idea Published in Match at an APE price of $4.16 approx.