Protocol Spotlight: TLX

Introduction

TLX allows users to mint and redeem leveraged tokens (LTs) across a diverse range of assets. The platform offers up to 7x leverage on majors $BTC and $ETH, while offering up to 5x leverage on altcoins such as $SOL, $SUI, $SEI and $PEPE. Built on the Optimism layer-2 solution of the Ethereum blockchain, TLX integrates with Synthetix's perpetual futures contracts to provide a permissionless and non-custodial platform for leveraged trading. The amount of assets will increase as TLX rolls out on Base and Arbitrum in the near future.

Before diving deeper into the mechanics of LTs and the protocol overall, here’s an amazing video by TLX that simply explains how the protocol works:

https://x.com/TLX_FI/status/1846558932627521716

Understanding Leveraged Tokens

Leveraged tokens are ERC-20 tokens that offer leveraged exposure to an underlying asset while maintaining the leverage factor within a targeted range. Unlike traditional perpetual futures contracts, which require active margin management to prevent liquidation, leveraged tokens automatically adjust their leverage through a process known as rebalancing. Due to this mechanism, users get constant leverage, outperforming regular perps if the directional trade is correct.

Mechanics of TLX Leveraged Tokens

TLX's leveraged tokens are underpinned by several key components:

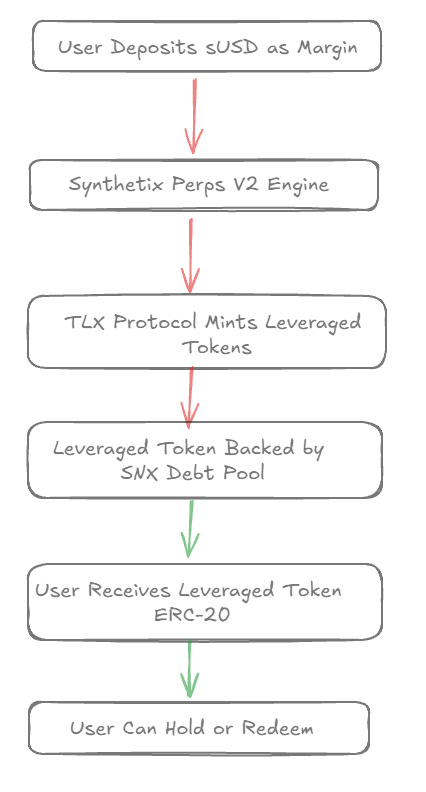

Synthetix Perpetual Futures Integration: Each leveraged token on TLX is backed by Synthetix's Perps V2 engine, allowing users to gain synthetic exposure to the underlying asset price via LTs. Users' margins are denominated in sUSD, and the counterparty to all leveraged tokens minted on TLX is the SNX debt pool.

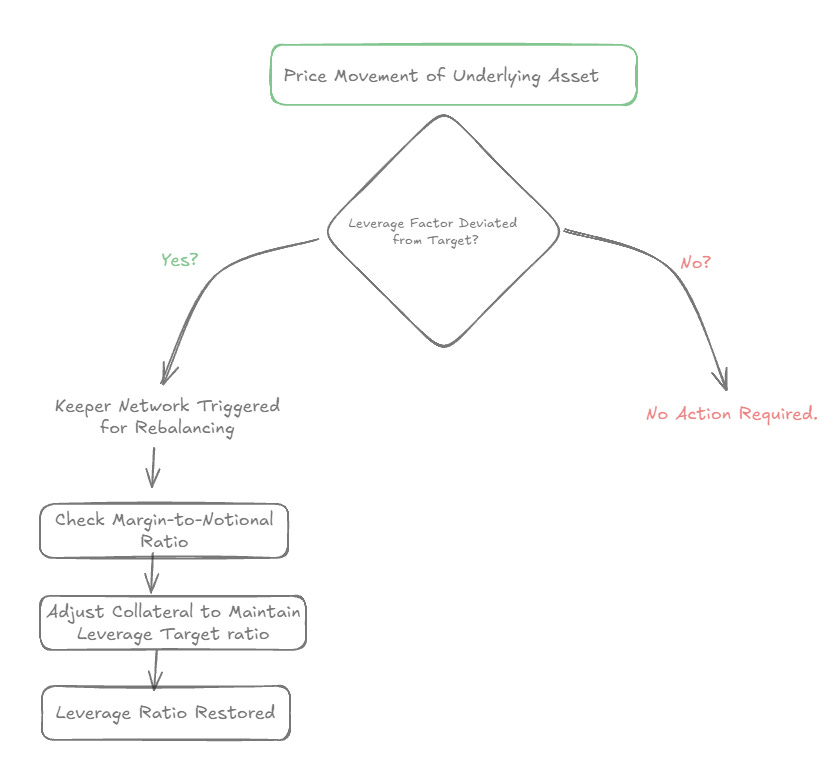

Constant Leverage Maintenance: TLX's leveraged tokens maintain their leverage factor within a target range through reactive rebalancing. This process involves adjusting the margin-to-notional ratio to ensure constant leverage, thereby eliminating the necessity for margin management by the holder.

Rebalancing Mechanism: Rebalancing is triggered when the leverage factor deviates from its target range due to price movements of the underlying asset. This adjustment helps mitigate the impact of volatility and maintains the desired leverage exposure. However, it's important to note that while rebalancing can amplify returns during one-directional price movements, it may also lead to volatility decay in fluctuating markets.

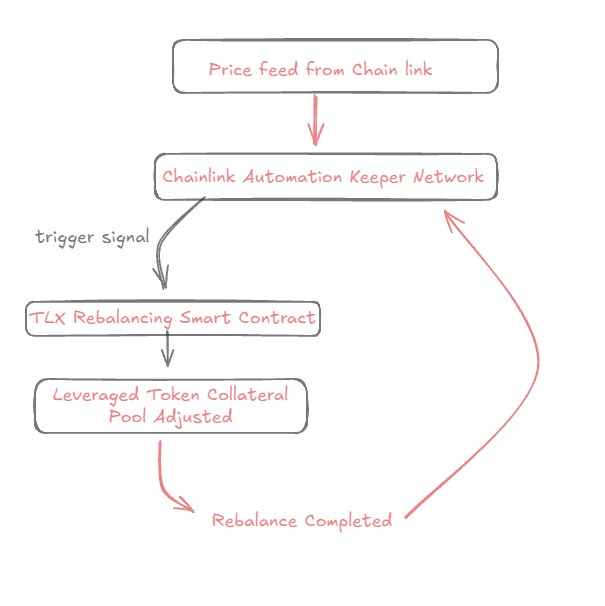

Keeper Network: To facilitate timely rebalancing, TLX employs a decentralized network of keepers responsible for monitoring prices and triggering rebalancing events. TLX has partnered with Chainlink, utilizing their Automation product as the primary keeper system. This setup ensures that rebalancing occurs efficiently and securely.

ERC-20 Compliance and Composability: Leveraged tokens on TLX adhere to the ERC-20 token standard, making them compatible with a wide range of De-Fi applications. This compliance allows users to transfer leveraged tokens, trade them on decentralized exchanges, or integrate them into other protocols seamlessly.

Key Features of TLX

Revenue Distribution to Stakers: TLX distributes 100% of platform fees directly to TLX token stakers, incentivizing participation and aligning users' interests with the protocol's success.

No Liquidation Risk: The automatic rebalancing mechanism of TLX's leveraged tokens eliminates the need for margin management, thereby eliminating liquidation risk. This feature provides users with a more secure and user-friendly leveraged trading experience.

No Minting Fees: Users can mint leveraged tokens without incurring any fees. Fees are only paid fees when redeeming LTs, which can be reduced through using the referral system.

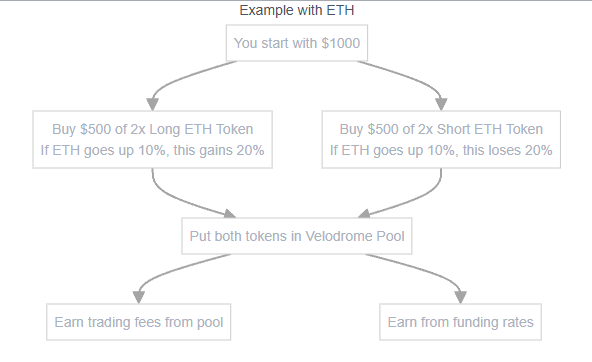

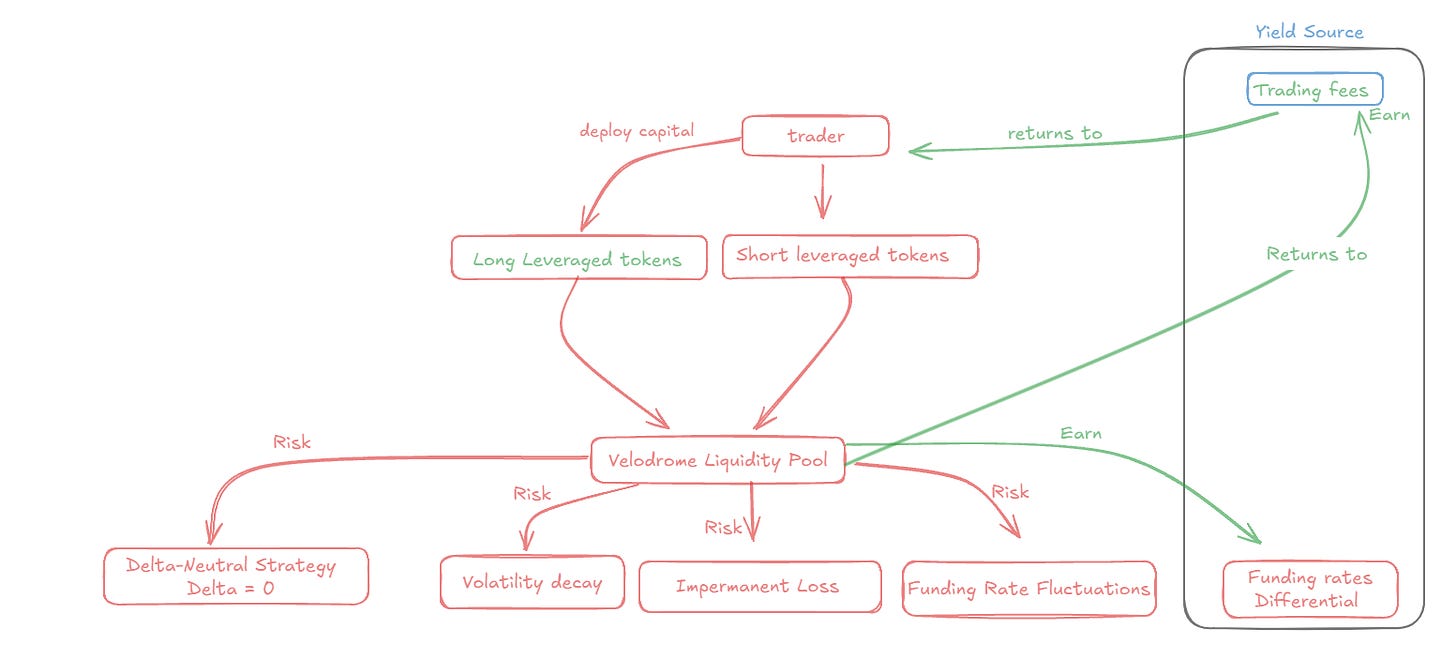

Delta Neutral Strategies: TLX's leveraged tokens can be utilized in automated market makers (AMMs) like Velodrome to farm funding rates, allowing users to earn yields through delta-neutral strategies. This approach enables users to benefit from funding rate differentials without taking on directional market risk.

Understanding Delta-Neutral Strategies

Delta-neutral strategies involve balancing positive and negative delta positions to achieve a net delta of zero, insulating the portfolio's value from small price movements. Traders can then focus on factors like volatility or time decay to generate returns.

Simplified Example:

Split $1,000 into two positions:

$500 in spot ETH (e.g., wstETH).

$500 in 1x Short ETH leveraged tokens (ETH1S).

If ETH's price moves up or down by 10%, the gain or loss on the spot side will offset the movement in the leveraged token side, keeping your portfolio stable at $1,000. You earn through trading fees in the Velodrome pool and funding rates, where long positions often pay shorts. However, risks like impermanent loss, volatility decay, and funding rate fluctuations may affect profitability.

Leveraged Tokens and Delta-Neutrality

TLX offers leveraged tokens that provide amplified exposure to underlying assets without the complexities of margin management. These tokens are designed to maintain a constant leverage ratio through automatic rebalancing, eliminating the risk of liquidation. By holding both long and short-leveraged tokens in equal proportions, a trader can create a delta-neutral position, as the positive delta from the long position offsets the negative delta from the short position.

Advantages of Using TLX Leveraged Tokens in Delta-Neutral Strategies

Compared to farming funding rates manually (the cash/carry trade), where frequent rebalancing of positions is required, TLX's leveraged tokens automate this process. Margin is maintained on the perps side, and the ratio between long and short positions (staying delta-neutral) is automatically managed by the AMM (liquidity pool). Unlike Ethena, which also provides auto-management but involves counterparty risk due to reliance on CEXs and custodians, TLX offers a truly decentralized and non-custodial solution.

No Liquidation Risk: The automatic rebalancing mechanism of TLX's leveraged tokens does not require margin management, thereby eliminating the risk of liquidation.

Composability: As ERC-20 tokens, TLX's leveraged tokens are compatible with various DeFi platforms, allowing seamless integration into AMMs like Velodrome.

Considerations and Risks

While delta-neutral strategies can mitigate directional risk, they are not without challenges:

Volatility Decay: In highly volatile markets, the rebalancing process may lead to volatility decay, potentially eroding returns over time.

Impermanent Loss: Providing liquidity in AMMs exposes traders to impermanent loss, which occurs when the value of deposited assets diverges from holding the assets individually.

Funding Rate Fluctuations: Funding rates can vary, and unexpected changes may impact the profitability of the strategy.

$TLX Token Economy

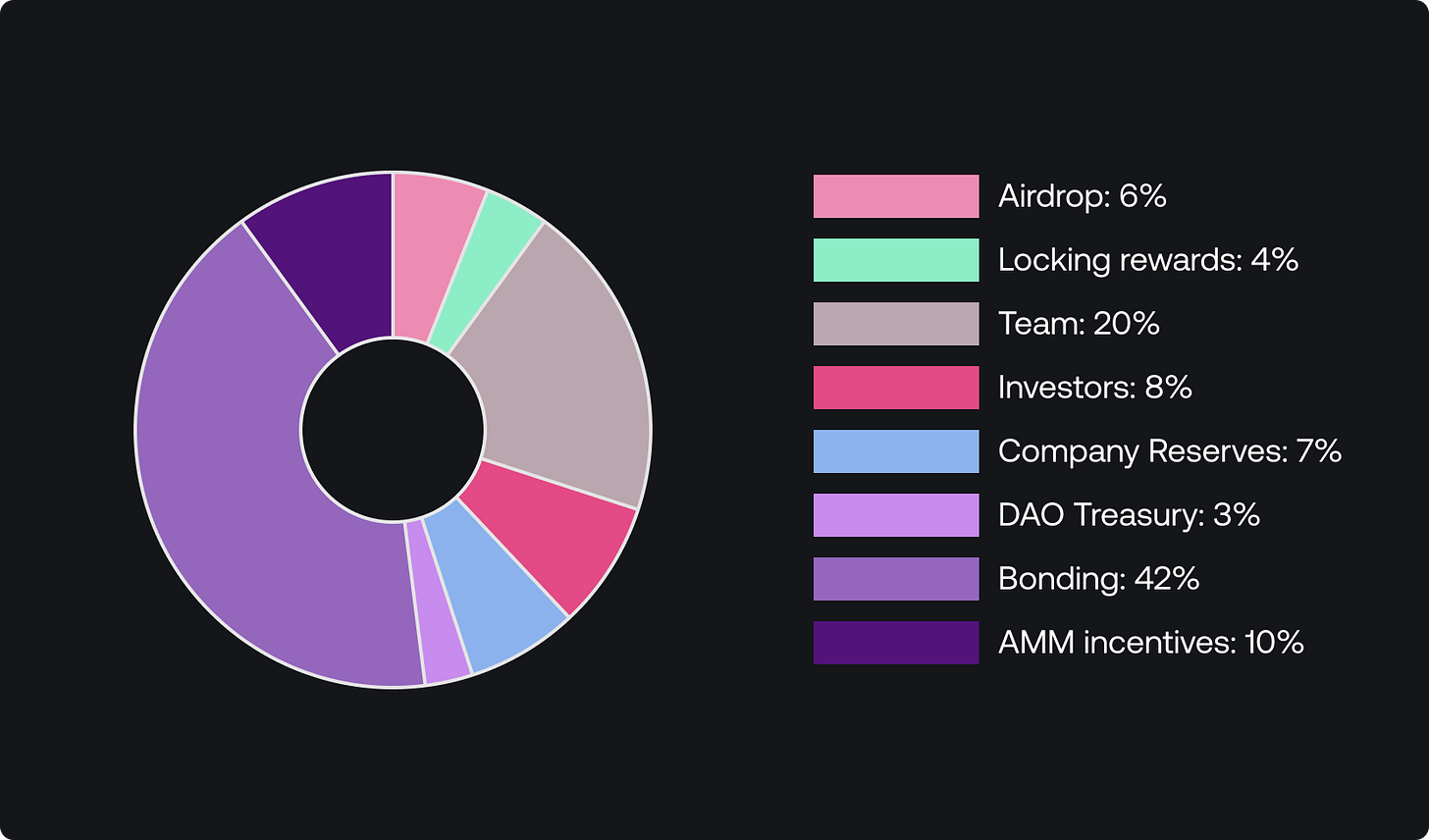

Total Supply and Allocation

$TLX is the governance token of the TLX protocol, with a total supply of 70 million tokens. Initially, 100 million tokens were created, but 30 million were burned following TIP 12 to reduce the supply. An additional 4.56 million of unused tokens were moved to the protocol treasury.

The distribution of $TLX tokens is divided as follows:

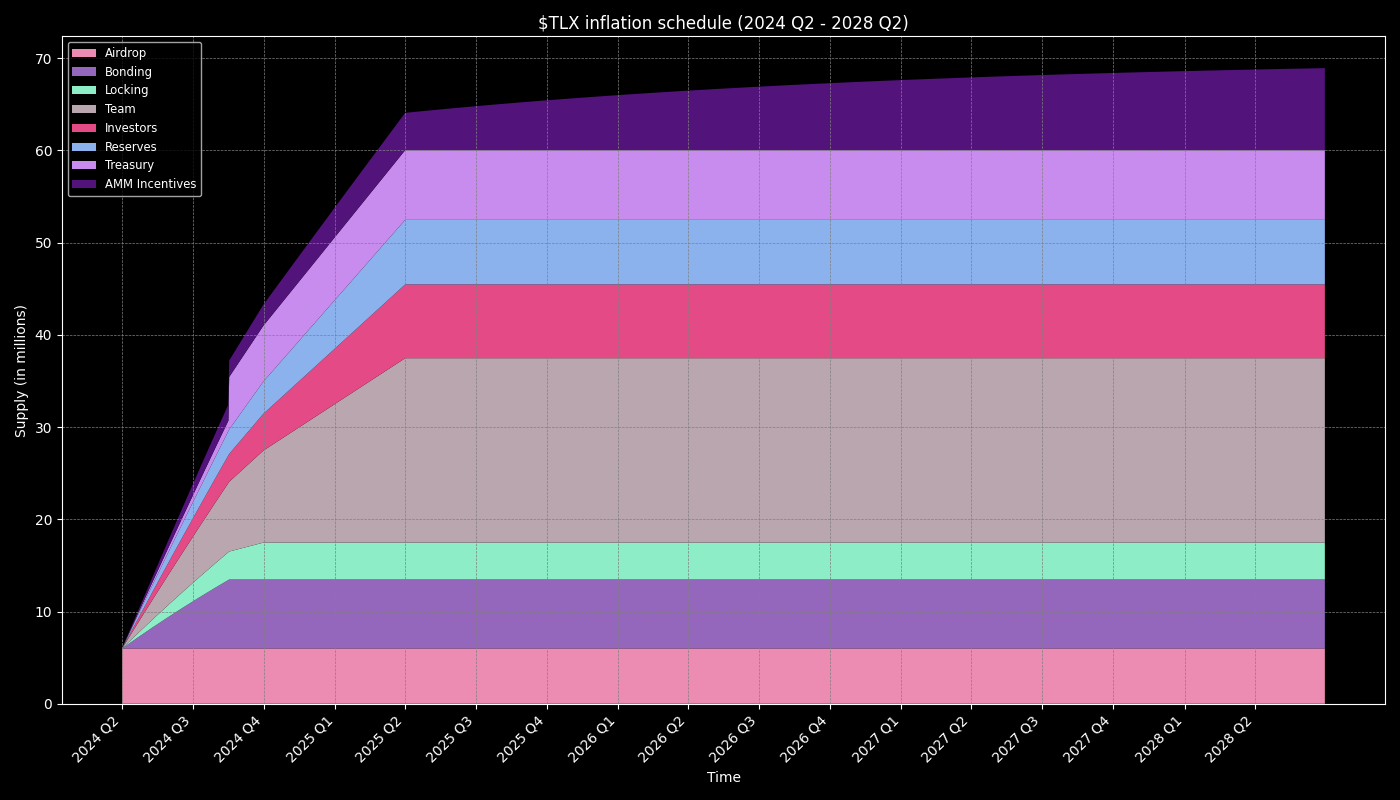

Emission and Vesting Timeline

The $TLX token release follows a planned schedule to maintain a steady supply. The emission occurs over a span of four years, with linear vesting for tokens allocated to core contributors, investors, and the treasury. This ensures sustainable distribution while minimizing sell pressure and incentivizing long-term engagement.

Staking and Governance Participation

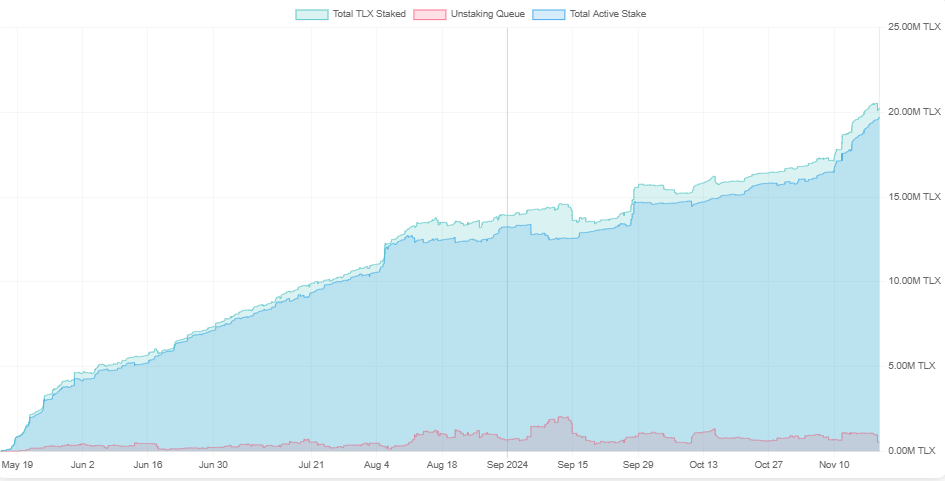

Staking $TLX allows users to actively participate in governance and share in protocol fees. By staking, users receive $stTLX, which provides voting power and the right to a share of the platform's revenues. Users can initiate an unstaking process, which requires a 5-day waiting period.

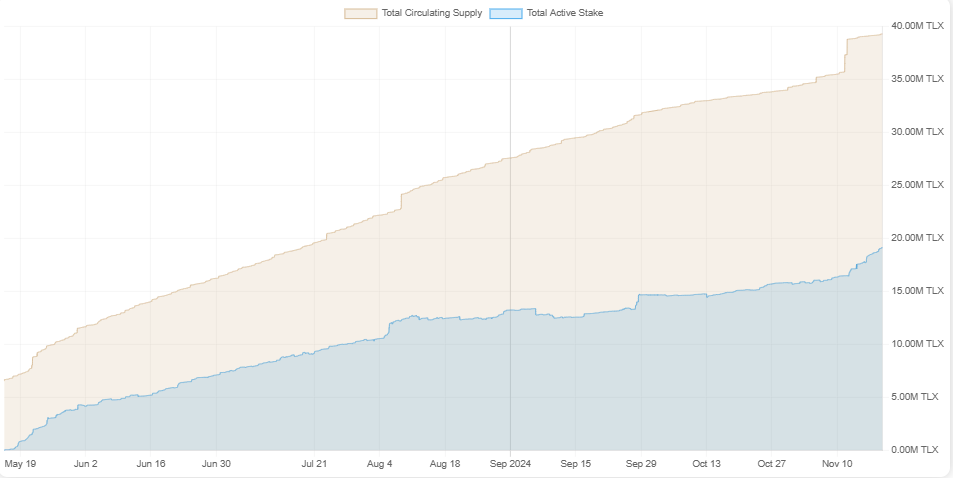

As of the latest data, the total amount of TLX staked has shown a consistent upward trend, reaching over 20 million TLX, indicating increased community engagement and confidence in the protocol. The unstaking queue remains relatively low despite market fluctuations.

$TLX Supply has reached nearly 40 million tokens, while the total active stake has continued to grow, surpassing 20 million TLX, meaning a significant portion of the circulating supply is being actively staked.

AMM Liquidity Incentives

To support decentralized trading, 10% of the $TLX supply is allocated to incentivize liquidity through AMMs. The $TLX/ETH pool on Velodrome is the initial focus, with rewards distributed based on voting by $veVELO holders. This initiative improves trading accessibility and rewards liquidity providers for supporting the ecosystem.

Trading Incentives:

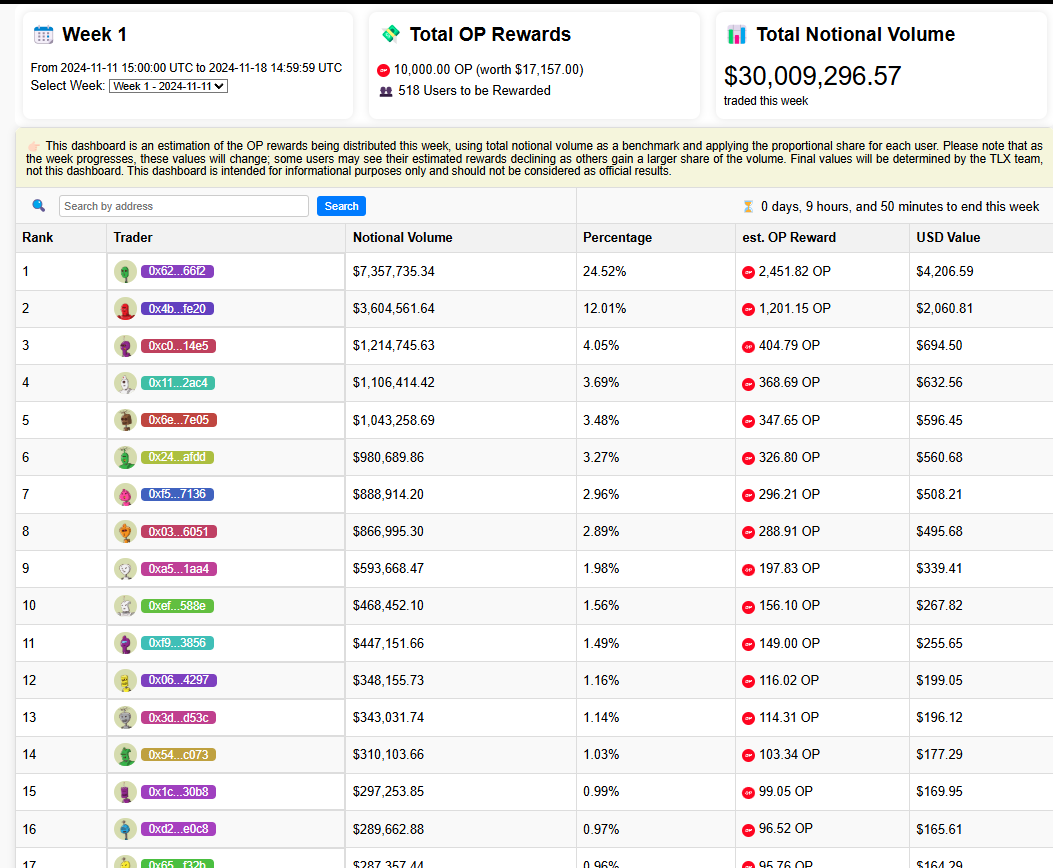

During the first week of the trading incentives program, from November 11, 2024, to November 18, 2024, a total of 10,000 OP tokens were distributed as rewards. Throughout this period, the platform facilitated a cumulative trading volume of $30,009,296.57. The OP rewards program will continue until December 16, 2024.

Governance Structure

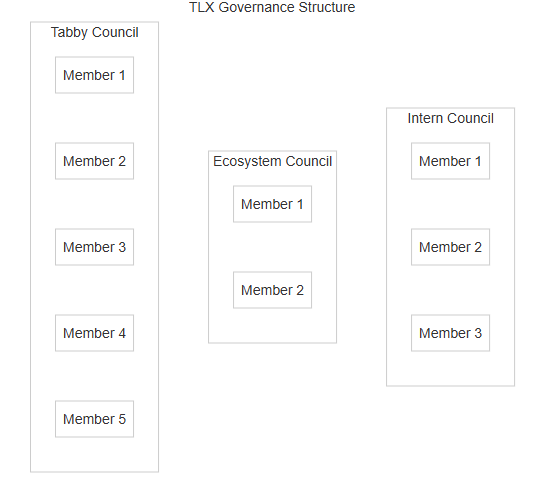

TLX employs a council-based governance model, comprising three councils:

Tabby Council (5 seats): The central governing body responsible for voting on overall improvement proposals and parameter changes.

Ecosystem Council (2 seats): Represents the interests of the TLX community and ensures alignment with other projects in the Optimism ecosystem.

Intern Council (3 seats): Focuses on community communications and maintaining the protocol's standards.

Council members are elected by stTLX (staked $TLX) holders every four months, promoting decentralized and community-driven governance.

Recent Developments:

Governance Update and Token Burn:

In alignment with TIP 12, TLX executed a burn of 30 million $TLX tokens from the bonding supply, effectively reducing the total supply to 70 million tokens.

Optimism (OP) Grant and Trading Incentives:

TLX secured a grant from the Optimism Foundation and is utilizing the grant through a trading incentives program. This initiative is designed to attract more traders to the platform by offering rewards in OP tokens, thereby increasing liquidity and trading volume.

Upcoming Updates:

Transition to Synthetix V3:

TLX is preparing to transition to Synthetix V3, which is expected to offer enhanced scalability, improved user experience, and additional features. This upgrade aims to provide users with more efficient and cost-effective trading options on more blockchains.

Expansion of Asset Support:

The platform plans to expand its range of supported assets, allowing users to access leveraged tokens for a broader spectrum of cryptocurrencies and synthetic assets. This expansion is intended to cater to diverse trading preferences and strategies.

Links

Website: https://tlx.fi/

Discord: https://discord.gg/xngYHVt5jx

Github: https://github.com/TLX-Protocol