Protocol Spotlight: WMTX World Mobile Chain

Introducing WMTX and World Mobile

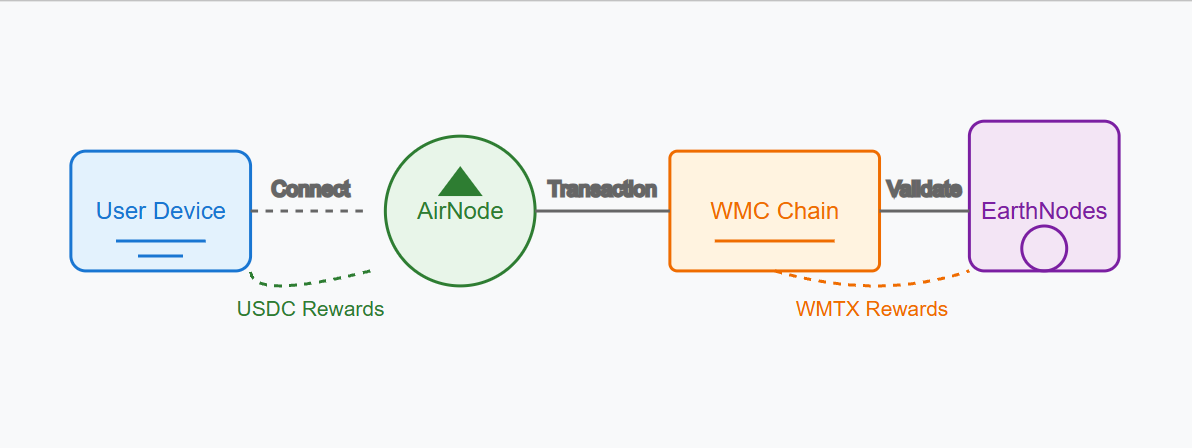

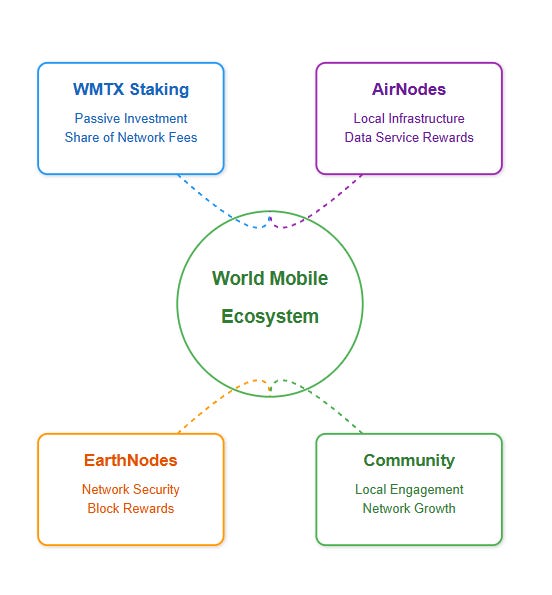

$WMTX is the native utility token of World Mobile, a pioneering DePIN initiative in the telecommunications space. World Mobile’s mission is to deliver affordable, accessible, and community-owned mobile network service and internet connectivity around the globe. Instead of relying solely on large towers and expensive proprietary hardware, World Mobile’s network consists of a patchwork of locally deployed access points, known as AirNodes, interconnected through a blockchain-powered settlement layer called the World Mobile Chain (WMC).

$WMTX fuels the transactions on the network. When a user anywhere in the world connects to the internet through a community-owned AirNode, the fees for that data usage are rewarded to operators in stablecoins or USD. Earth Node operators, stakers, and participants in the network’s growth are rewarded in WMTX. Thus, $WMTX is both the medium of exchange and the incentive mechanism, ensuring that all stakeholders remain aligned in their goal to expand and maintain a robust, community-centric telecom network.

What is DePIN?

Decentralized Physical Infrastructure Networks (DePIN) represent a new category of blockchain-based ecosystems in which real-world infrastructure—such as telecommunications towers, internet access nodes, energy grids, and sensor arrays—is owned, operated, and maintained by a decentralized community rather than a single corporate entity or government monopoly. Instead of traditional models in which infrastructure is capital-intensive and centrally controlled, DePIN leverages blockchain technology, smart contracts, and incentive tokens to distribute ownership and responsibilities globally.

In a DePIN model, participants can invest in and deploy the physical assets that form the backbone of critical services. These assets include wireless access points, edge compute servers or network validators. Each participant earns rewards proportionate to their contribution and adherence to performance standards. By doing so, DePIN aligns economic incentives with the public good, democratizing the provision of infrastructure services, reducing costs, and potentially accelerating deployment in underserved regions.

Why DePIN Matters for Connectivity

Traditional telecom operators have long struggled to reach the roughly half of the world’s population that remains unconnected or under-connected. The reasons range from insufficient profit margins in rural or low-income areas to regulatory barriers, high capital expenditures (CAPEX), and complex operational logistics. Even with well-financed attempts by large technology companies—such as balloon-based internet projects or drone-delivered connectivity—sustainable and affordable models remain elusive.

DePIN offers a fundamental shift: by distributing infrastructure ownership across many stakeholders, it becomes economically viable to cover areas previously deemed unprofitable. The community-driven approach can lower operational costs, enhance transparency, and ensure that revenues flow directly back to local contributors, rather than distant shareholders. Over time, this can empower local entrepreneurs, foster community resilience, and bridge the digital divide.

2. The Problems Solved by World Mobile: Global Connectivity Gaps and Traditional Telecom Limitations

The Global Connectivity Gap

According to various international organizations and industry reports, nearly 4 billion people still do not have consistent access to the Internet. This digital divide is more than just an inconvenience. It prevents millions from accessing basic online services like telehealth, digital education, microfinance, e-commerce, and governmental information. The lack of connectivity stifles economic development, entrenches inequality, and limits social mobility.

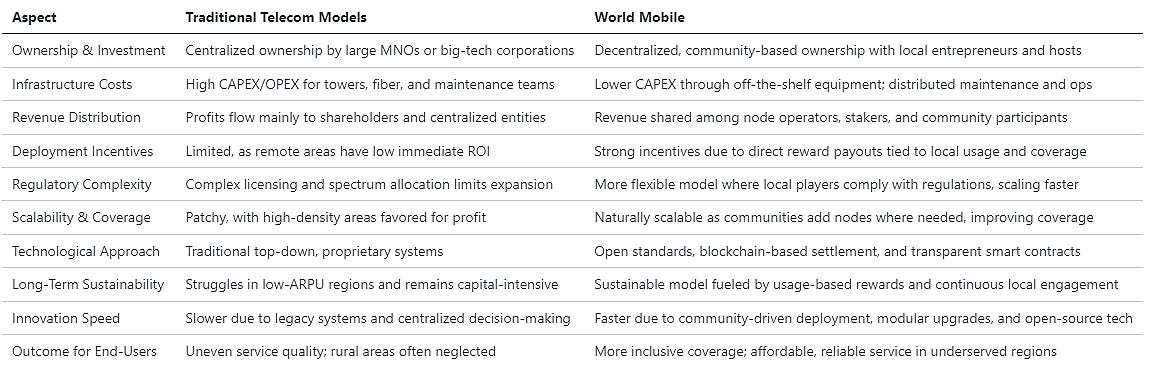

Traditional Telecom Models and Their Shortcomings

Historically, connecting rural or low-density areas has been economically challenging for large Mobile Network Operators (MNOs). The infrastructure required—massive cell towers, fiber optic backhaul, ground teams for maintenance—is expensive. Revenue potential in these areas often fails to offset the costs. Additionally, regulatory complexities, licensing requirements, and spectrum allocations can further complicate expansion.

These factors have led to a patchwork of coverage, with urban centers enjoying 4G or 5G speeds while rural communities remain stuck with unreliable or non-existent connectivity. Even attempts by well-funded corporations to provide network access through non-traditional means (such as satellites, balloons, or drones) have struggled to find a viable long-term business model.

How World Mobile Provides a Different Approach

World Mobile reimagines telecom infrastructure as a community-owned asset. By leveraging a DePIN structure, the network encourages local entrepreneurs, businesses, and individuals to invest in and operate nodes that deliver connectivity. Instead of one central player bearing all costs and reaping all rewards, World Mobile’s shared economy ensures that those who deploy and maintain the infrastructure at the edges of the network also benefit financially.

Because the World Mobile ecosystem relies on open standards and affordable off-the-shelf equipment, it significantly reduces CAPEX for last-mile connectivity. The rewards paid out to Earth node operators come directly from user-generated transaction fees, which are settled in $WMTX. This creates a virtuous cycle: more nodes lead to better coverage, attracting more users, which generates more fees and, in turn, rewards Earth node operators and stakers, incentivizing further network growth.

3. Inside the World Mobile Ecosystem: AirNodes, EarthNodes, AetherNodes, and the Sharing Economy

Three Types of Nodes

AirNodes:

Air nodes are the primary access layer. They might be Wi-Fi hotspots, broadband receivers, or small cellular units that end-users connect to directly. An AirNode could be owned by a small business owner, or a community cooperative or by anybody in the world remotely. Remote owners provide the capital and match with the local hosts who in turn maintain the infrastructure. Once installed, every data packet passing through this AirNode generates revenue, paid in stablecoins or USD.

Quality Control:AirNode owners must maintain adequate uptime, bandwidth, and service quality. Performance metrics are recorded on-chain. If an AirNode consistently performs poorly, its share of rewards decreases, prompting operators to keep their equipment running optimally.

EarthNodes:

EarthNodes run the World Mobile Chain’s validation layer. They process network transactions, execute smart contracts, and secure the blockchain. To operate an EarthNode, one must stake a certain amount of $WMTX, as well as possess an EarthNode NFT. These nodes ensure data integrity and play a vital role in maintaining network consensus.

Rewards for EarthNodes:

EarthNode operators earn WMTX through block production and transaction validation. The more stake delegated to an EarthNode by token holders, the higher its chance of producing blocks and earning rewards. This forms an incentive for EarthNodes to remain reliable and for WMTX holders to carefully select which nodes they stake their tokens with.

AetherNodes:

AetherNodes interface with legacy telecom infrastructures—connecting World Mobile’s decentralized mesh to traditional backhaul options like fiber, satellite, or established carrier networks. Operators of AetherNodes must comply with local regulations and licensing, bridging the gap between the decentralized network and existing telecom infrastructure.

The Sharing Economy Model

This node structure forms the basis of a sharing economy. Instead of a top-down model, World Mobile’s network emerges from thousands of stakeholders placing nodes wherever connectivity is needed. A data session on an AirNode triggers a chain of events: fees are recorded, settlements occur on WMC, and rewards in WMTX flow back to node operators and stakers. This self-sustaining cycle encourages continuous network expansion and improves accessibility.

4. The WMTX Token Economy: Distribution, Inflation, and Utility

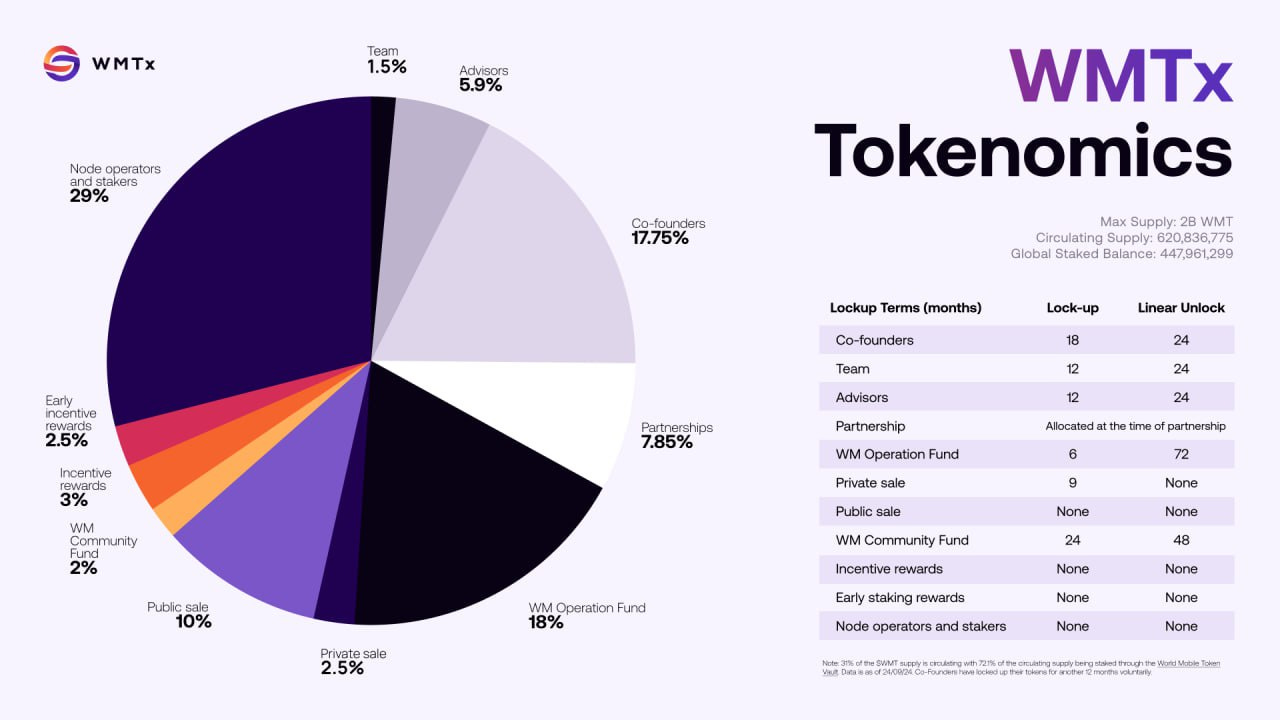

WMTX has a fixed maximum supply, distribution of the supply and respective vestings can be found on the image below:

Inflation and Supply Evolution

WMT employs a carefully calibrated inflation model to reward early adopters, node operators, and stakers who help secure and expand the network during its formative years. Over a 20-year timeframe, token inflation steadily decreases, encouraging early participation while eventually stabilizing the supply dynamics.

Initial Annual Inflation Rate: Approximately 11.41% at the outset.

Long-Term Supply Target: After 20 years, cumulative inflation accounts for around 29% of the original supply, increasing the total from 2 billion to roughly 2.58 billion WMT.

Tapered Inflation Curve: Inflation is front-loaded to favor those who take on initial risk, providing higher yields in the network’s early phases. As user growth, real-world usage, and fee-based revenues ramp up, inflation recedes. By the 20-year mark, inflation effectively nears zero, ensuring that the ecosystem transitions from an inflation-driven incentive model to one sustained primarily by genuine network activity and demand.

Reward Mechanisms and Inflation

In the early stages of the network, inflationary rewards encourage participants to take on the risk and effort of building and maintaining infrastructure before large-scale user adoption occurs. Over a roughly 20-year timeline, WMTX inflation gradually tapers off, approaching zero. This design rewards early contributors for their pioneering role while ensuring the token’s supply doesn’t balloon indefinitely.

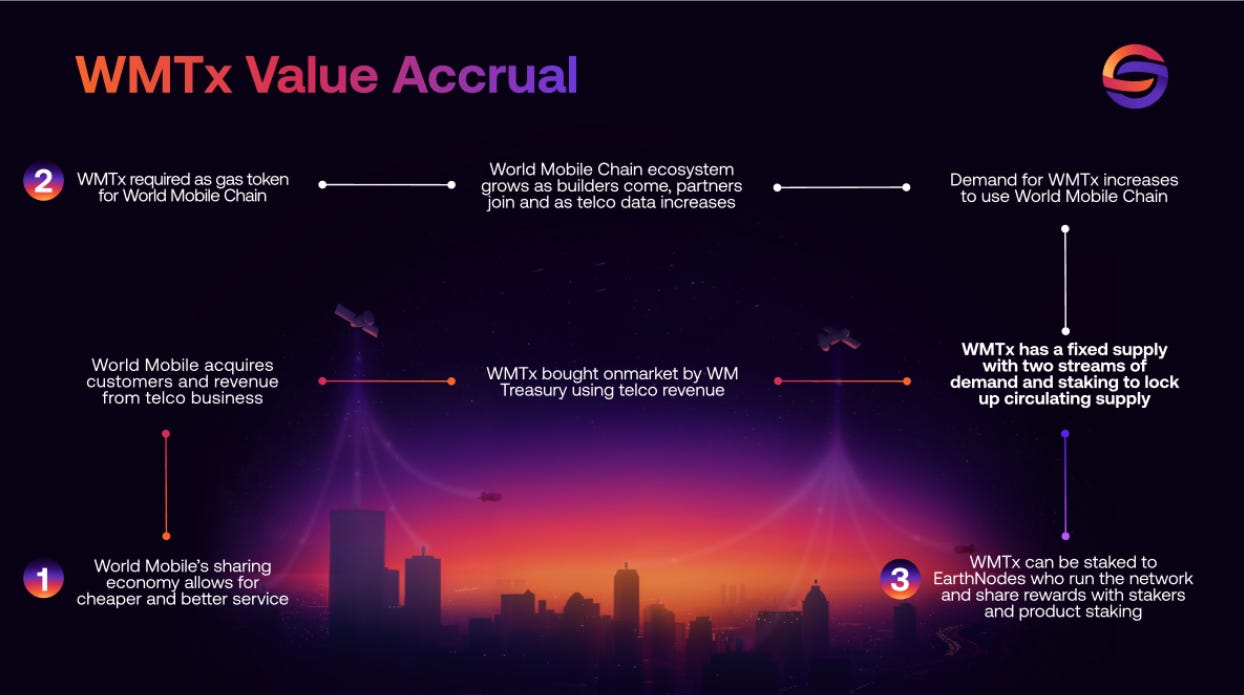

Token Utility and Value Proposition

WMTX is required for every on-chain transaction—every data packet monetized, every call minute billed, every storage or VPN service added in the future. Beyond paying transaction fees, WMTX can be staked for yield, locked into smart contracts for product-specific discounts (e.g., SIM staking), or used as collateral for securing other value-added services.

As the network grows, demand for $WMTX should theoretically increase since more transactions require the token for settlement. Meanwhile, the supply growth diminishes over time. This creates a dynamic where token utility and scarcity interplay, potentially driving long-term value appreciation.

Liquidity and Multi-Chain Presence

$WMTX is available on various decentralized exchanges across multiple chains, ensuring ample liquidity and multiple options for the user and investor base. $WMTX is available on Cardano, Ethereum, BSC, Base and Arbitrum blockchains, with the highest liquidity available being on Cardano, followed by Base. The token is also available on multiple centralized exchanges such as Kucoin, HTX and Gateio.

About World Mobile Token ($WMTX)

$WMTX is the native gas token that powers the World Mobile Chain (WMC), acting as the foundational currency for every transaction and value transfer within the network’s ecosystem. Whether a user is browsing the internet through an AirNode in a remote village or an EarthNode operator is validating a block, $WMTX is the indispensable medium of exchange. This ensures a direct link between user activity and token demand, establishing $WMTX as a critical component of the network’s economic engine.

Beyond its fundamental role as a transaction settlement medium, $WMTX serves multiple utilities that enhance participant engagement and value creation:

Staking for Yield and Utility:

Node operators and token holders can stake their $WMTX to EarthNodes, and even specific network products—such as SIM cards or unique mobile numbers—to earn additional rewards. For example, a user might stake $WMTX to their SIM, receiving discounts on data packages and earning cashback paid out in $WMTX. This transforms passive token holding into an active strategy, promoting network security, incentivizing continuous service improvements, and embedding the token deeply into everyday connectivity experiences.Treasury Buybacks and Revenue Redistribution:

Unlike traditional telecom models, World Mobile takes a portion of its telco revenue to buy back $WMTX from the open market. These purchased tokens are then redistributed as rewards to EarthNode operators and their stakers. This buyback mechanism introduces a form of ongoing demand for $WMTX, potentially supporting its long-term value. As the network’s user base and revenue streams expand, so does the volume of $WMTX buybacks, creating a positive feedback loop between network growth and token utility.Fixed Supply and Evolving Demand:

$WMTX has a fixed supply, ensuring that inflationary pressures diminish over time. As user adoption, transaction volumes, and corporate partnerships increase, the demand for $WMTX intensifies—both as a fee token and as a yield-generating asset. This interplay between fixed supply and growing usage could position $WMTX as a long-term, utility-driven digital asset within the telecommunications and DePIN sectors.

5. Market Traction: Usage Data, Milestones, and Network Growth

Data-Driven Evidence of Progress

World Mobile grounds its story in tangible metrics. For instance, early testnet and pilot deployments have reportedly onboarded hundreds of thousands of daily active users across various regions. Thousands of AirNodes have been tested, and the network continues to refine its protocols that is already capable of handling real-world conditions.

Showing Growth Over Time

A timeline might highlight key milestones:

Initial Testnet Launch: Demonstrations of basic connectivity for a pilot community.

Reaching 550K Daily Active Users (DAU): Validation that the model works under load.

Scaling AirNodes to Thousands: Indicative that entrepreneurs and communities find value in deploying infrastructure.

Geographic Expansions: Entry into new regions—rural Africa, parts of the U.S., Asian regions needing affordable connectivity—shows adaptability.

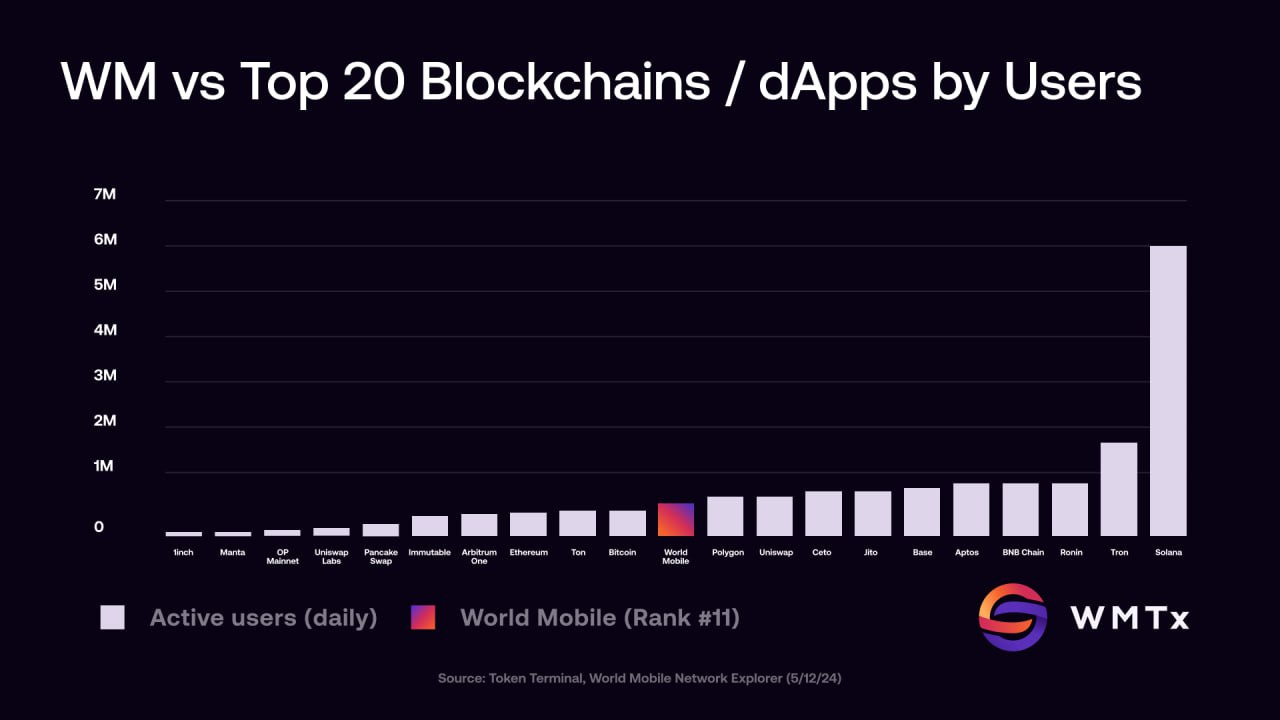

5.1 Competitive Landscape and Valuation

Comparable projects like Helium and Peaq have commanded valuations substantially higher than World Mobile’s current market cap, yet fall short in terms of real-world utility and adoption metrics. While World Mobile continues to expand its user base, node infrastructure, and revenue streams, it also stands out within the broader DePIN ecosystem while boasting competitive numbers accross the wider blockchain industry.

For instance, World Mobile boasts 37x more data usage than Helium and serves 6x more customers, even before the launch of its nationwide U.S. SIM. Whereas Helium relies on a single MNO partner (T-Mobile) for its MVNO offering, World Mobile’s upcoming SIM product leverages licensed spectrum and strategic roaming partnerships (e.g., AT&T), ensuring more comprehensive coverage and a superior user experience.

Beyond simple connectivity, World Mobile has begun distributing stablecoin-based rewards to hundreds of node operators and executing on-chain buybacks of $WMTX—demonstrating a level of tangible, revenue-driven token utility that remains unparalleled among its peers. This dynamic positions $WMTX not only as a fundamental utility token for one of the largest DePIN networks but also as the “fuel” for an infrastructure layer that could attract established telecom giants into its ecosystem.

Taken together, these factors suggest that $WMTX may be significantly undervalued relative to its potential. While Helium commands a valuation near $1.4B and Peaq hovers around $450M, World Mobile’s superior metrics, robust ecosystem, and on-chain revenue mechanisms give it strong credentials to rival—and potentially surpass—these projects over time. With a current valuation of around $230M, $WMTX could offer a compelling opportunity for stakeholders seeking exposure to a growing DePIN ecosystem backed by tangible, real-world usage and revenue streams.

6. Beyond Token Holding: Participation Paths in the World Mobile Ecosystem

Staking WMTX

Not everyone needs to operate a node. By staking $WMTX with EarthNodes, token holders can earn a share of the network’s transaction fees and inflationary rewards. This delegative model democratizes access to yield from telecom services, allowing passive investors to support the network and benefit from its growth.

Operating an AirNode

Local entrepreneurs can become AirNode operators by purchasing or assembling node equipment and setting it up in areas where demand exists, or by purchasing remotely and matching with hosts who maintain the infrastructure. By doing so, they transform into micro-ISPs, earning stablecoin rewards directly tied to data consumption in their vicinity. This provides income and empowers local businesses to invest in the digital future of their communities.

Running an EarthNode

For more technically inclined participants, running an EarthNode provides opportunities for deeper involvement. EarthNodes require technical know-how, higher capital (for acquiring the NFT and staking WMTX), and reliable internet and computing infrastructure. In return, operators earn a share of block rewards, transaction fees, and potential premium services as the network evolves.

7. Recent Developments and Media Highlights

Several key developments are set to differentiate World Mobile and $WMTX from competitors:

Base L3 Mainnet Integration:

Once the WMC mainnet goes live (currently on testnet), it will operate as a Base Layer-3 (L3) solution, onboarding potentially hundreds of thousands of customers into the on-chain economy. This scale and complexity go beyond the experimental stages seen in other DePIN projects. With $WMTX as the gas token and economic backbone, the network can settle enormous volumes of telecommunications data and financial transactions on-chain, bringing Web3’s benefits—transparency, trustlessness, decentralization—directly to everyday telecom users.Live Documentary Release on Mario Nawfal’s broadcast:

An hour long documentary titled ‘‘Connecting the Disconnected’’ was released on a live broadcast on the most popular broadcast on X. You can watch it via this link: https://x.com/marionawfal/status/1866597085946187992?s=46&t=VLTZfLE4MeydJ3JTbXcdgQ

Token Migration: World Mobile transitioned from WMT to WMTX to enhance interoperability across multiple blockchains, including Ethereum and Binance Smart Chain. The migration aimed to broaden reach and improve network resilience. World Mobile Token FAQ

Market Integration: Proposals have been made to list WMTX on platforms like Liqwid, enabling lending and borrowing functionalities, which could increase token utility and liquidity. Liqwid Finance

8. Future Roadmap and Upcoming Updates

U.S. National SIM Launch:

World Mobile plans to release a U.S. national SIM, leveraging licensed spectrum and strategic roaming partnerships (e.g., AT&T) to surpass coverage offered by MVNO rivals that rely on a single carrier (like T-Mobile in the case of Helium’s solution). This U.S. SIM stands out as an innovative crypto-integrated telecom product: users will be able to stake $WMTX to their SIM, unlocking discounts, cashback in $WMTX, and a superior customer experience supported by a more reliable nationwide network. This marks the first time a crypto asset integrates so closely with a live, nationwide cellular offering, potentially revolutionizing how consumers perceive and utilize utility tokens.

Expanding Global Coverage:

World Mobile’s near-term goals include deploying more AirNodes in Africa, Asia, Latin America, and underserved areas of the U.S. The strategy focuses on regions with high demand for affordable connectivity, leveraging local entrepreneurs to drive growth.

Enhanced Token Utilities:

Upcoming features will include staking SIM cards or phone numbers with WMTX, offering discounts on data plans, or integrating with DeFi platforms for micro-loans and insurance products. As the token’s utility expands, it creates new user experiences and potentially drives token demand.

Enterprise Integrations and IoT:

Beyond consumer connectivity, World Mobile could partner with enterprises to deliver IoT services—such as environmental sensors, agricultural data feeds, or secure data storage nodes. Each additional use case bolsters network traffic and strengthens WMTX’s role as the network’s settlement layer.

Reference And Project links:

Website:

https://worldmobiletoken.com/

https://airnode.worldmobile.net/ (For Airnode operators)

X Accounts:

https://x.com/wmtoken

https://x.com/WorldMobileTeam

Telegram group:

https://x.com/WorldMobileTeam

Discord:

https://discord.gg/worldmobile